Intel Corp’s earnings missed expectations by a penny in the fourth quarter due to weak spending on servers, and the chipmaker gave a lukewarm forecast for first-quarter revenue that did little to dispel concerns about a slowing PC industry.

Intel Corp’s earnings missed expectations by a penny in the fourth quarter due to weak spending on servers, and the chipmaker gave a lukewarm forecast for first-quarter revenue that did little to dispel concerns about a slowing PC industry.

Intel said on Thursday it overestimated the extent of a recovery in spending among its enterprise customers, sending its stock lower, and pointed to political controversy in Washington, D.C.

In the December quarter, Intel’s PC revenue stayed flat, which it said was slightly better than the company expected.

Microsoft Corp’s plan to stop supporting its Windows XP operating system in April had spurred hopes that some corporations will replace employees’ PCs. But Intel Chief Financial Officer Stacy Smith said the Windows refresh had a minor impact on the quarter.

Personal computer sales are losing ground to tablets and smartphones – a market Intel has been slow to enter – but some analysts believe the industry’s decline is tapering, potentially giving Intel breathing room as it struggles to develop better processors for mobile gadgets.

The company has also bet that sales of high-end server chips will help offset lower revenue from PCs this year, as the proliferation of smartphones creates demand for data centers to provide Internet-based services like video and social media.

But Smith said Intel’s data center group revenues in 2014 would probably come in toward the bottom of his previous growth estimate of 10 percent to 15 percent.

The 8 percent increase in server revenue in the fourth quarter was less than Intel and some analysts expected.

“The incremental nugget we got from Q4 earnings was that datacenter group disappointed again,” Evercore analyst Patrick Wang said. “Investors were anticipating a fairly healthy beat and raise.”

Intel forecast revenue of $12.8 billion, plus or minus $500 million, for the first quarter, which ends in March. Analysts had expected $12.79 billion on average.

Intel has been slow to adapt its processors for smartphones and tablets, markets now dominated by rivals like Qualcomm Inc and Samsung Electronics Co Ltd .

And its core market is crumbling. Global PC shipments fell 10 percent last year, the worst annual drop since research firm Gartner began tracking them.

HOPE SPRINGS ETERNAL

Smith partly blamed Intel’s miss in fourth-quarter server chip sales on quarreling over U.S. fiscal policy.

“We saw a tapering off in order patterns across certain customers in certain segments at the end of the quarter, and we think that was driven by the government shutdown and the uncertainty around the debt ceiling,” he told analysts.

But the CFO pointed to new computing devices, such as PCs with detachable screens and other new designs, as potential growth drivers.

“The PC market was a little stronger than we thought,” Smith told Reuters. “What’s driving PCs right now are the innovative form factors we’ve been working on.”

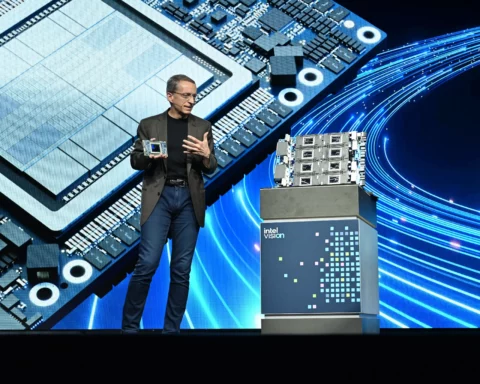

At the Consumer Electronics Show in Las Vegas last week, Chief Executive Officer Brian Krzanich showed off a handful of wearable computing devices, including prototype earbuds with a built-in heart rate monitor.

But industry watchers believe smart clothing is not ready to make a splash with consumers any time soon and is unlikely to make up for much of the business that Intel has lost due to a shrinking PC industry.

Intel posted fourth-quarter net earnings of $2.6 billion, or 51 cents a share, compared with $2.5 billion, or 48 cents a share, in the year-ago quarter as the chipmaker grapples with a shrinking PC industry and finds support from demand for more servers.

Wall Street had expected 52 cents a share on average, according to Thomson Reuters I/B/E/S.

Fourth-quarter revenue was $13.8 billion, compared with $12.5 billion in the year-ago quarter, it said in a statement on Thursday. Analysts had expected $13.72 billion in revenue for the fourth quarter, according to Thomson Reuters.

Shares of Intel slid 4.8 percent in extended-hours trading on Thursday after ending the regular session down 0.49 percent at $26.54 on the Nasdaq.

One analyst pointed to heightened spending in the first quarter as potentially worrisome.

“You’re getting quite a bit less earnings in the first quarter than the Street may have been looking for,” said RBC Capital Markets analyst Doug Freedman. “This management team is not running this company to deliver earnings.”

Source-NDTV