ING Vysya Bank Ltd. selected IBM (NYSE: IBM) and the company’s IBM MobileFirst solutions for the development of its ING Vysya Mobile, a cost effective, secure and scalable mobile banking app. Launched in July, the new app will effectively enhance the bank’s reach into untapped markets, such as remote cities and rural areas. Additionally, the app will improve engagement with the bank’s customers through new personalized features that provide greater availability and convenience to its services.

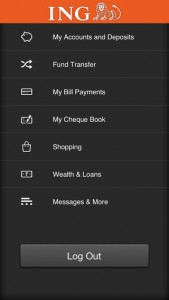

For instance, using the ING Vysya Mobile app, customers can now use their mobile devices to pay utility bills, transfer funds to other accounts, view mini-statements, request check books, stop payment of checks, and locate the nearest ATM and branches, among many other features. As a result, customers are able to manage their accounts and financial performance more efficiently.

As the banking industry in India is becoming more competitive, forward-thinking organizations have started to adopt alternative channels like mobile and the Internet for banking services. These services will help ING Vysya Bank to build an effective ecosystem for its customers to interact across multiple access channels, as well as extend its services across India.

The ING Vysya Bank, a premier banking service provider in India, has always been on the forefront of IT adoption. With just over 530 branches across India servicing more than two million customers, ING Vysya Bank required an application development platform to quickly and securely build new mobile banking solutions. In addition, mobile banking will allow the bank to further differentiate itself with better, more personalized services.

The bank selected IBM Worklight, an integral part of the IBM MobileFirst solutions portfolio, to help create cross-platform apps, as well as manage the whole app development life cycle. Using this technology, the bank has reduced the time to market and cost for product development. IBM Worklight also provides secure connectivity with the client’s back-end systems, allowing it to efficiently manage version upgrades, user data and audit data. With data capture capabilities, the bank is able to analyze patterns and trends of customer usage.

As the mobile revolution continues to change the way we interact with customers, transforming our services to meet these demands and deliver a consistent customer experience, regardless of the device or operating system, has become critical to our growth,” said Aniruddha Paul, chief information officer, ING Vysya Bank. “With an IBM mobile solution, we are now able to quickly and easily roll out new mobile services to support our business growth strategies.

The bank is the first IBM Worklight client in India to go live with a publicly downloadable app. Currently available on the Apple iOS mobile platform, ING Vysya Mobile apps will soon be extended to other platforms such as Android, BlackBerry and Windows Phone.

ING Vysya Bank’s mobile strategies that are focused on speed and improving the customer experience are in line with the findings of a new study from the IBM Institute for Business Value that studied trends in enterprise mobility. For example, one of the key strengths of an effective mobile environment is the timely delivery of information and insight to service customers regardless of location. In fact, 58 percent of all respondents selected “faster response time to customers” as a key benefit of using mobile.

It has become mission-critical for organizations to have a mobile presence, given increasing customer demands,” said Naveen Gupta, business unit executive, IBM India/South Asia. “Many companies want to build mobile apps with the same features as their web counterparts, without compromising on user experience. IBM MobileFirst helps clients dramatically reduce mobile app time to market and ensure cost effectiveness.