HIGHLIGHTS

-

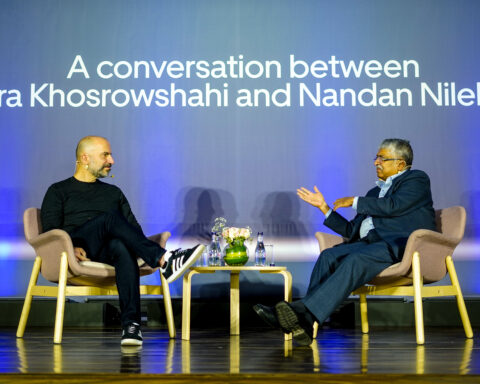

Uber will be focussing on winning the Indian market by leveraging technology to cut costs

-

It hands out Rs 125 as incentive to drivers per trip across most Indian cities

-

The game of discounting was triggered when Uber entered India two years ago