The largest producer of smartphone processors, Qualcomm Inc., released quarterly earnings that indicated progress in the chipmaker’s drive into new industries, such as computers and automobiles, which helped lessen the effects of a protracted decline in mobile-handset sales.

Qualcomm reported a 12% decline in first-quarter revenue to $9.46 billion, falling short of analysts’ average forecast. The first quarter ended on December 25. Even though sales of handsets fell 18% to $5.75 billion, that figure above estimates of $5.25 billion and was higher than some analysts had projected. To reach $456 million, automotive sales increased by 58% from a year earlier. Revenue from connected devices increased 7% to $1.68 billion.

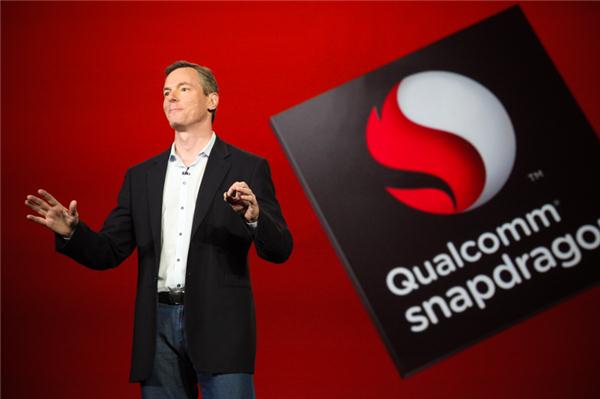

In a move to minimise its reliance on the smartphone industry, the business has stepped up its efforts to sell chips to various industries under Chief Executive Officer Cristiano Amon. Nevertheless, Qualcomm’s sales decrease and a dismal estimate for the current quarter show that demand for mobile phones is still being held back by sluggish consumer spending on expensive things in a shaky economy.

Even the highest end of the market isn’t immune to smartphone problems, as evidenced by the company’s shares, which initially increased after the earnings announcement but fell about 2% in extended trading. This acceleration of decline came after chip customer Apple Inc. reported iPhone revenue for the December quarter that fell short of analysts’ estimates.

Qualcomm anticipates that customers that have built up sizable inventories of unused parts will finish reducing their inventories around the middle of the year and revert to more predictable order patterns in the second half. According to executives speaking on a conference call with analysts, the relaxation of Covid-related limitations on China’s population should start to boost consumer demand in the largest market for phones in the world.

“There is optimism that the second half could be better,” Amon said. “Beyond 2023 for Qualcomm we see many of our growth initiatives gaining scale.”

In normal New York trading, Qualcomm shares, which have increased by 24% so far this year, finished at $135.85. They increased to a high of $141.89 on the company’s announcement before declining to $131.50.

The chip that powers many of the most well-known mobile devices in the world is Qualcomm’s flagship item. Additionally, it offers the modem chips needed to connect the iPhone to fast data networks. The underlying technology that supports all contemporary mobile networks is licenced by Qualcomm for a portion of its revenue; phone manufacturers must pay these fees whether or not they utilise Qualcomm-branded chips.

Due to increased demand for Qualcomm’s Snapdragon processors from Samsung Electronics Co., which uses them increasingly in its Galaxy phones, the semiconductor manufacturer has been able to sidestep some of the worst effects of the recent slowdown. As it continues to work on creating its own replacement chips, Apple has also continued to purchase from Qualcomm for a longer period of time than anticipated.

For the first quarter, the company reported an adjusted profit of $2.37 per share. On average, analysts anticipated per-share earnings of $2.35.

Contrary to analyst projections of $9.58 billion in sales, Qualcomm said in a statement on Thursday that revenue will be between $8.7 billion and $9.5 billion in the fiscal second quarter. With some things excluded, the current period’s earnings could be as low as $2.05 per share, compared to the average expectation of $2.29.