Pega CLM reduces costs and saves time while improving client experience by automating complex onboarding and KYC processes

Pegasystems, the software company empowering the  world’s leading enterprises with strategic business applications, today announced Pega Client Lifecycle Management (CLM), an application that streamlines and automates client onboarding – one of the most costly and time consuming functions burdening global banks. By orchestrating complex CLM processes on a global scale in a single unified application, Pega CLM reduces onboarding time by 70 percent, reduces costs by 60 percent, and dramatically improves the customer experience.

world’s leading enterprises with strategic business applications, today announced Pega Client Lifecycle Management (CLM), an application that streamlines and automates client onboarding – one of the most costly and time consuming functions burdening global banks. By orchestrating complex CLM processes on a global scale in a single unified application, Pega CLM reduces onboarding time by 70 percent, reduces costs by 60 percent, and dramatically improves the customer experience.

A recent study revealed that 88 percent of banks identify ever growing Know Your Customer (KYC) regulations as negatively impacting client onboarding times – which delays time to revenue and diminishes client satisfaction and retention. Pega CLM introduces a transformative approach to complex entity onboarding by taking a traditionally linear process and instead driving activities in parallel. From client adoption, enrichment, and KYC to credit, legal, and risk assessment through to fulfillment, Pega CLM coordinates all steps from front office to back office across multiple geographies, products, and stakeholders based on pre-defined industry best practices. This enables corporate and institutional banks as well as asset management and wealth organizations to deploy a simpler and more cost-efficient system that speeds time to revenue and ensures global compliance while providing a differentiated experience for their clients.

Available immediately, Pega CLM extends the functionality of the Pega Onboarding application to simplify the institutionalized complexity that encumbers the world’s largest financial institutions by enabling them to:

Realize faster time to revenue – With a fully extensible data model and a 360-degree master view of the customer, banks can easily reuse data to drive complex multi-jurisdictional, multi-product onboarding for new and existing clients. This enables banks to onboard new products faster than ever before and realize new revenue streams without delay. Pega CLM fully integrates with leading KYC utilities such as kyc.com (powered by Markit and Genpact) and Clarient to further streamline the time to transact. The application also enables bank customers to retrieve and integrate KYC profile data seamlessly into onboarding and reference data systems.

-

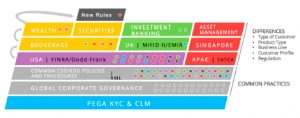

Deliver quicker response to changing regulations – With full integration with the Pega KYC application, Pega CLM ensures adherence to global, country, and product-specific regulations with best-practice due diligence rules. In partnership with leading regulatory advisor and global law firm DLA Piper, Pega KYC stays up to date on the latest regulatory rule changes affecting client onboarding for all major markets, including AML, FATCA, CRS, MiFID II, Dodd-Frank, and EMIR.

-

Scale for the most complex global organizations – Pega CLM is the only solution in the market that can scale globally to support the onboarding process through to KYC. Built on the highly flexible and scalable Pega 7 platform, the application drives onboarding processes across a limitless number of entities, jurisdictions, and lines of business and can be easily modified to meet any bank’s unique needs.

-

Provide better client experiences – Pega CLM enables banks to quickly onboard customers to improve the client journey and increase retention rates. Pega CLM dashboards provide relationship managers and clients with a single view and complete transparency into the process. They can also engage seamlessly across any channel and device – from laptop, tablet, and smartphone to email, chat, and co-browse – so all parties know the latest status.