The clamour for spectrum saw telcos go the whole hog in many circles, where they bid even higher compared to the auctions in the bumper 3G sale in 2010. The enthusiasm was seen not only in the lucrative Delhi and Kolkata circles in the highly-efficient 900 MHz band, but also in many circles in the 1,800 MHz frequency, generally considered to be more costly in terms of starting operations.

The clamour for spectrum saw telcos go the whole hog in many circles, where they bid even higher compared to the auctions in the bumper 3G sale in 2010. The enthusiasm was seen not only in the lucrative Delhi and Kolkata circles in the highly-efficient 900 MHz band, but also in many circles in the 1,800 MHz frequency, generally considered to be more costly in terms of starting operations.

Data released by the Department of Telecomshows that prices in Kolkata were nearly double in the 900 MHz band than what was paid in the 3G auctions in 2100 MHz band. The top bid for the airwaves in the city was at Rs 195 crore and both Airtel and Vodafone made an aggressive pitch here as their licences were facing expiry. Delhi also witnessed a stiff competition, though the bids in the national capital were marginally higher than what was paid in the 3G sale.

While cut-throat action was anticipated in the 900 MHz band, demand for 1,800 MHz frequency in some of the smaller cities came in as a surprise. Assam and Bihar were cases in point, especially as the prices there were higher than what was paid for 3G airwaves.

30422056

Assam was the favourite among the operators as the final bid price was over four times to what was paid during the 3G sale. Operators ended up paying Rs 36 crore per MHz of spectrum in the north-eastern state, taking many by surprise. This was also five times the reserve price that was fixed by the government before the auctions.

Ajay Srinivasan, director (industry research) at Crisil, said the race for airwaves in smaller towns was higher perhaps due to their lower mobile penetration and a higher chance of greater play in voice. He added that many of the operators fought for the airwaves in the 1,800 MHz band as it is being seen as a viable option for 4G against the 2,300 MHz earmarked earlier.

“With the liberalization of spectrum, a telco is free to offer whatever service it wants in a band. The 1,800 MHz band is seen as more efficient for 4G and this also holds more potential in data when compared to 3G. Thus, companies fought aggressively in many circles, taking a long-term bet.”

An analyst at one of the top international brokerages said uncertainty about the next auctions and the pricing at that time also saw companies compete aggressively. “You really are not too sure about the timing of next sale, and especially of the prices. So the panic,” the analyst said.

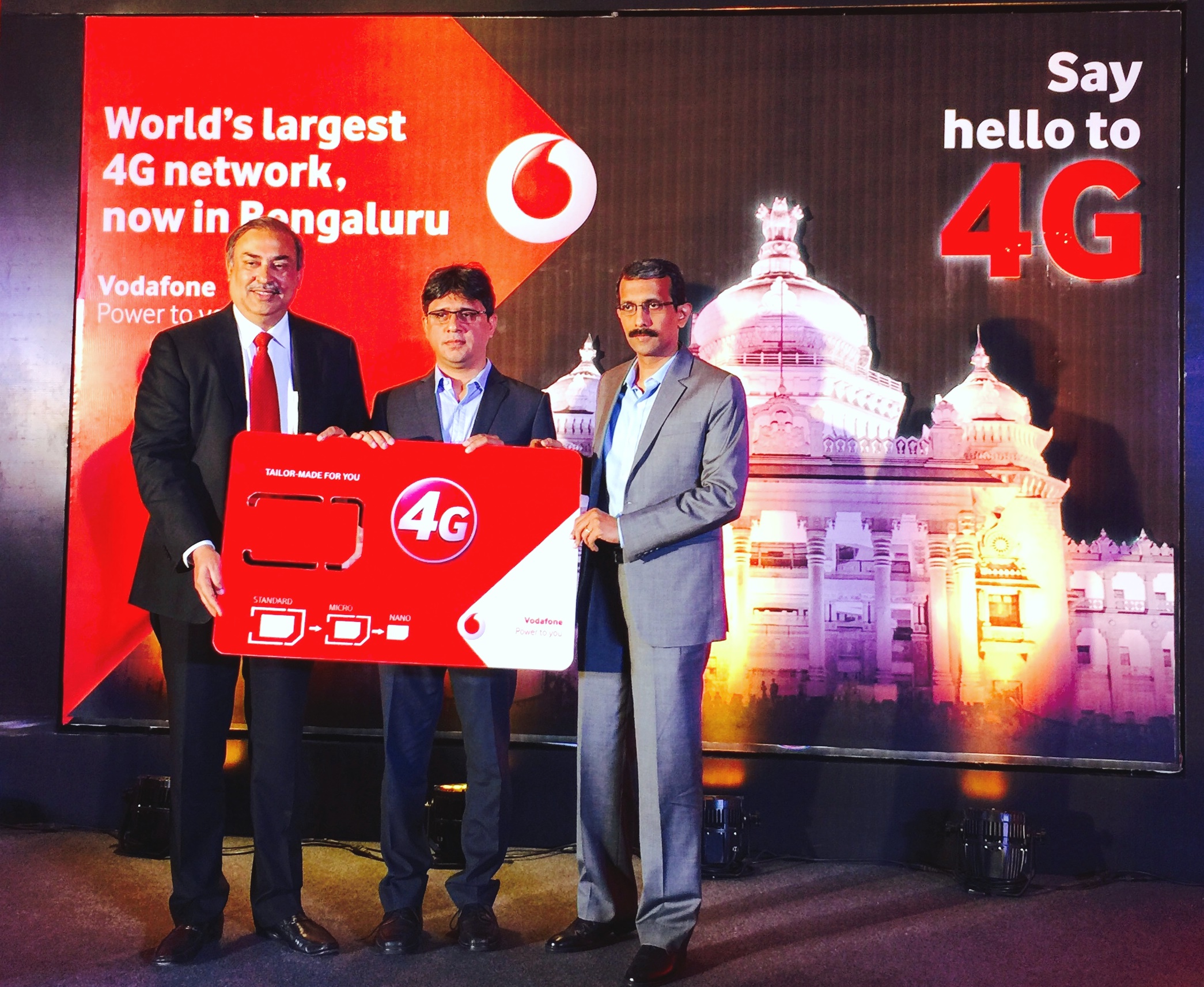

While bidding aggressively, companies did complain about the high prices. Airtel said prices in the 900 MHz frequency were “artificial and unrealistic”. Martin Pieters, CEO of Vodafone India, said the debt-laden industry will be under further pressure.

Hello it’s me, I am also visiting this site regularly, this web site is genuinely nice and the visitors are really sharing pleasant thoughts.