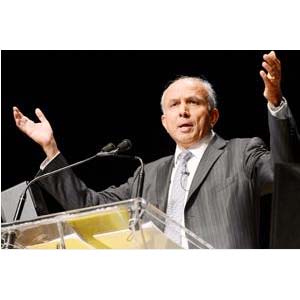

MUMBAI: Prem Watsa, the founder of Fairfax Financial Holdings, is one of the first-generation expatriate-entrepreneurs in Canada who has built successful businesses but remains below the radar. Alongside his Canadian success stories, the India-born Watsa also has a robust presence in his home country through his holdings in well-known consumer-facing businesses.

MUMBAI: Prem Watsa, the founder of Fairfax Financial Holdings, is one of the first-generation expatriate-entrepreneurs in Canada who has built successful businesses but remains below the radar. Alongside his Canadian success stories, the India-born Watsa also has a robust presence in his home country through his holdings in well-known consumer-facing businesses.

Fairfax Group owns India’s largest tour operator Thomas Cook, is a partner in ICICI Lombard, India’s leading private non-life insurer, and is also a significant shareholder in IndiaInfoline, one of the leading financial services companies in the country. It has investments of close to a billion dollars in Asia’s third largest economy and plans to make Thomas Cook the ‘acquisition and investment vehicle’ for its India play. Fairfax entered the Indian market 13 years ago when its group company Lombard inked a non-life insurance joint venture with ICICI Bank.

While its India presence was restricted to general insurance for a long time, things started to change in 2011 when Watsa brought on board private equity deal maker Harsha Raghavan. Within a year Fairfax acquired nearly a 10% stake in Nirmal Jain-promoted IndiaInfoline. It followed it up with the buyout of British tour operator Thomas Cook’s India business. Globally, Watsa is known for his long-term approach to investments and the same is expected about his India holdings.

Jain, who knows Watsa for about five years now, said that since his company came on board with IndiaInfoline, it has benefitted from his insight about the global financial services business and also his ability to spot trends. At present, IndiaInfoline has eight subsidiaries outside India.

Sources said Watsa envisions Thomas Cook to acquire and build businesses in India, something like a holding company structure with several other businesses under its fold. A beginning has been made on this front with Thomas Cook acquiring HR solutions firm Ikya. More such buyouts are expected over the next few years. With the fast growth of Watsa’s business footprint in India, it would probably be difficult for the billionaire to remain below the radar for long.

source : Times of India

www.itvoice.in