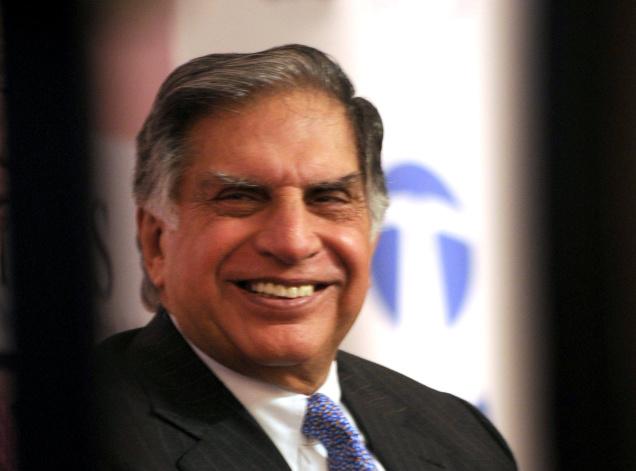

Ratan Tata has made a personal investment in online jewellery retailer Bluestone as the former Tata Group chairman scales up his exposure to India’s red hot e-commerce sector which has attracted a steady stream of investor money. Tata, 73, now chairman emeritus of Tata Sons, the holding company of the $100 billion steel-to-software Indian conglomerate, has subscribed to fresh shares of the three year-old e-commerce player which sells jewellery targeted at women buyers. The size of Tata’s investment could not be ascertained by TOI. He joins a list of pedigree angel investors and venture capital firms backing the Bangalore-based company founded by IIT graduate Gaurav Singh Kushwaha and Vidya Nataraj, and seed-funded by the serial entrepreneur duo Meena Ganesh and K Ganesh.

Tata made his maiden e-commerce investment last month when he picked up a small stake in Delhi-based Snapdeal by buying out an early investor, first reported by this newspaper. His latest move is interesting considering Tata group’s brand Tanishq emerged as a billion dollar jewellery retailing enterprise under his watch.

“An investment by Ratan Tata who has been at the helm of India’s most successful and respected conglomerate is a validation of our approach in building an innovative brand that is disrupting the jewellery market,” Bluestone’s Kushwaha told TOI. Bluestone is a vertically integrated online jeweler with its own manufacturing, designs and delivery functions which competes with the likes of Caratlane.com backed by Tiger Global. Venture Capital funds Accel Partners, Kalaari and Saama Capital are Bluestone’s existing investors.

“Bluestone is targeting the modern Indian woman aged between 20 to 50 years, with contemporary designs and a huge selection. It offers one lakh designs and has a one week delivery schedule,” Ganesh, a co-promoter, said. “It’s a classic case how internet and technology are transforming a traditional capital intensive industry with just-in time inventory model,” he said. The online jewellery store is expected to have clocked around Rs 60 crore in sales.

Online jewellery retail is poised to be one of the fastest growing segments in India’s e-commerce market which is projected to become an $8 billion industry in the next two years. The current share of online sales in the $50 billion domestic jewellery market is a minuscule 0.5% providing it with big headroom to ride the wave of internet consumerism. India’s e-commerce boom is set to spawn several deep-domain specialists even as Flipkart, Amazon and Snapdeal dominate the horizontal play.

“Tata’s coming on board is a huge endorsement for the opportunity that Bluestone enjoys going forward. Having him as a mentor and getting access to someone of his stature will help the team learn immensly business wise as well,” said Vani Kola, MD, Kalaari Capital which led a $10-million investment in the e-tailer of curated jewellery earlier this year. Interestingly, Kalaari Capital is also an early investor in Snapdeal.

Higher merchandise value, hefty margins and low inventory costs make online jewellery a better prospect in an otherwise bleeding e-commerce sector. In the US, NASDAQ- listed Blue Nile, a specialty online retailer of diamonds and fine jewellery with a market value of about $350 million, competes with retail chains like Tiffany & Co and James Allen.