~PayUMoney is acquiring Eashmart, Aims to substitute cash payments with online payments

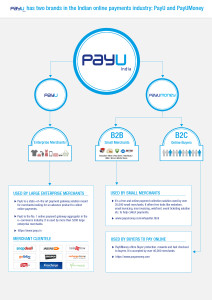

PayUMoney, an online payment solution by PayU India makes another strategic move towards cashless economy by acquiring Eashmart, a mobile based payment application. With this acquisition, PayUMoney is furthering towards its goal to replace cash payments with online payments.

PayUMoney, an online payment solution by PayU India makes another strategic move towards cashless economy by acquiring Eashmart, a mobile based payment application. With this acquisition, PayUMoney is furthering towards its goal to replace cash payments with online payments.

By enabling consumers to use credit/debit cards/net-banking to make payments for anything, the mobile app let users buy things without swiping the card in a swipe machine. One of the key features of this app is that it doesn’t require merchants to install or buy any hardware. It further eases the payment process by sensing the OTP (one-time password) from user’s mobile phone without having user to type password from the text messages.

Eashmart was founded by Amit Kumar and he along with his team has joined PayUMoney team where they will continue to help with the development of new app features.

Nitin Gupta, Co-founder and CEO, PayU India said, “At PayUMoney we are focused on accelerating growth and innovation in payment space. As fewer users carry cash and rely on card payments, the trend will increase and more physically present cash payments will start getting substituted by online payments. That’s why we are investing in best mobile based payment application to create the innovative mobile payment solution which makes online payment easy and ubiquitous.”

“PayUMoney is synonymous with the best payment solutions and is the ideal partner for us, strengthening our ability to make cashless transactions anywhere and anytime,” said Amit Kumar, Founder, Eashmart.

Increasingly, more and more customers do not carry cash but are forced to make a trip to ATM to pay for deliveries at home for things like food, groceries, pizza etc. Same is the case when a transaction happens at small mom and pop stores, for taxi payments etc. However, taxi companies like Uber, Meru, Ola, Taxiforsure etc. have demonstrated that the users are willing to pay online and prefer that. PayUMoney with this acquisition is addressing exactly this scenario.

With PayUMoney app, transactions can be easily paid online through the user’s mobile phone. All the user has to do is identify the shop/merchant, enter the amount and pay. In all cases real time confirmations is sent to user, delivery boy and the shop owner. There are more than 200 merchants live on this use case and see over 100 transactions every day. Bigbasket.com is piloting with this to offer an alternative to cash on delivery to its customers at time of grocery deliveries. Similarly, Yo! China’s Gurgaon outlets are using this product to offer an alternative to cash payments to the customer at time of home deliveries.

“PayUMoney is an awesome way to collect payments. Customers are appreciating the choice of payment modes they get on PayUMoney. The whole interface is so smooth and simple, that customers make payments in few clicks and seconds,” Sandeep Mahajan, Franchise Business Partner- Yo! China, runs two outlets in Gurgaon.

Along with this App, PayUMoney has also offered a SMS invoice feature to its merchants. It is a very simple tool where the retailer simply needs to send a SMS invoice with a payment link inside. The user can click on the payment link and pay online. PayUMoney also offers a search URL to users using which they can search for the merchant by name/email/phone number and pay. The app can also scan QR codes and allows the user to save recent favourites. This is backed by telephone and email support and the merchant receive the payment next day in his bank account.