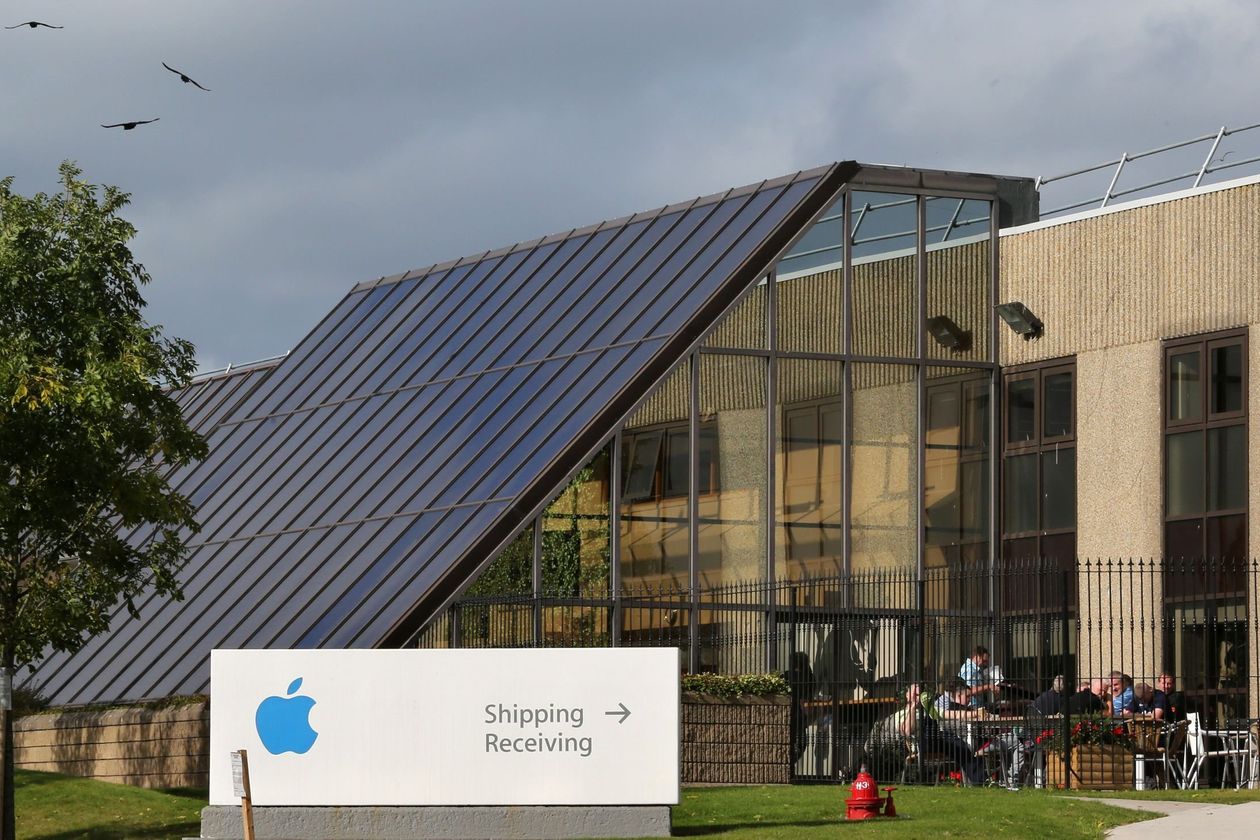

After being saved by the court earlier, Apple is again in a legal battle with EU over a $15 billion tax bill. Back in 2016, Apple had been found to have illegal tax breaks given by Ireland. This ruling however, was overturned in July 2020 by EU’s General Court claiming not enough evidence against the tech giant. The European Commission had accused Apple of using 2 shell companies to grossly under-report their profits from 2003 to 2014 in order to avoid taxes from the European Bloc.

Apple said that the appeal “will not alter the factual conclusion of the General Court, which proves that we have always abided by the law in Ireland, as we do everywhere we operate.” The Commission’s competition chief Margrethe Vestager, said that the court had made several errors of law in the ruling and therefore, they are taking the case to European Court of Justice. “Making sure that all companies, big and small, pay their fair share of tax remains a top priority for the commission,”she said.

Irish Finance Minister Paschal Donohoe said,”Ireland has always been clear that the correct amount of Irish tax was paid and that Ireland provided no state aid to Apple.” The case focuses at Ireland giving special treatment to Apple in order to get more international business and chance at a better revenue than normal. Multinationals working in EU have an option of paying taxes for their entire sale across the union in just the country where their regional HQ is located. This allows small nations to attract business and get revenues. However, this lets large firms escape by paying very low tax rates therefore destabilizing the market and the competition.

This case is probably the biggest of several lawsuits against multinationals using tax-aid in countries across EU. There has been a rise in talks about digital taxation and more strict guidelines on tax across the EU. Organization for Economic Cooperation and Development is expected to talk about digital taxation across borders in October this year. While Apple’s case will be long drawn, there is a possibility that this will lead to stricter tax reforms, irrespective of how long it takes to bring them into effect.